How Many Continuous Years Has Exxommobil Paid a Dividend

Brandon Bell

Elevator Pitch

I maintain my Buy rating on Exxon Mobil Corporation's (NYSE:XOM) stock.

I evaluated XOM's five-year or medium-term outlook in my previous article for the company published on April 1, 2022. This article touches on Exxon Mobil's appeal as a dividend play.

In my view, Exxon Mobil is a good dividend stock that justifies a Buy rating. XOM offers forward dividend yields in excess of 4%, and it has increased its dividend payout in every year for close to four decades.

XOM Stock Key Metrics

Before discussing Exxon Mobil's dividends, I assess XOM's most recent quarterly financial performance in the current section of the article.

Exxon Mobil reported the company's financial results for the second quarter of 2022 at the end of July, and both XOM's topline and bottom line beat market expectations. XOM's revenue jumped by +71% YoY from $67.7 billion in Q2 2021 to $115.7 billion in Q2 2022, which turned out to be +4% ahead of the market's consensus topline projection of $111.7 billion. Exxon Mobil's Q2 2022 non-GAAP adjusted EPS of $4.14 was +7% higher than Wall Street's consensus bottom line estimate of $3.89, and this represented a +276% YoY increase as compared to its Q2 2021 EPS of $1.10.

Besides delivering on better-than-expected headline financial metrics, XOM's key operating metrics were also impressive.

Exxon Mobil's Permian Basin production increased by around 130,000 barrels of oil equivalent per day in 2022 year-to-date. More importantly, the company has guided for full-year FY 2022 Permian Basin production to grow by +25% which is the same pace of growth it achieved in 2021, as indicated in its Q2 2022 earnings presentation.

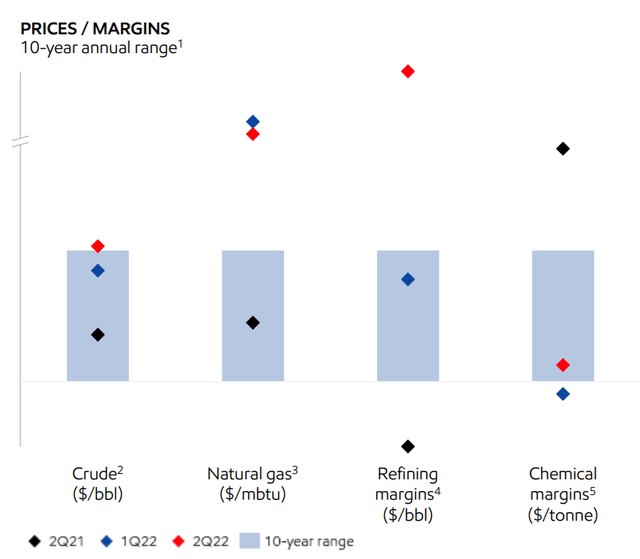

Separately, Exxon Mobil's refining margins for the second quarter of 2022 came in significantly higher than historical levels as per the chart below. While XOM's Q2 2022 chemical margins were at the lower end of its historical range, the company noted at its second-quarter earnings call that it witnessed "a slight improvement in the quarter", suggesting that chemical margins could have already bottomed out.

Exxon Mobil's Q2 2022 Margins As Compared To 10-Year Historical Range

XOM's Q2 2022 Earnings Presentation

Also, XOM's shareholder capital return metrics were encouraging. Exxon Mobil spent approximately $3.9 billion on share repurchases in the second quarter of 2022, which was equivalent to about 1% of its market capitalization. In late-April 2022, XOM disclosed that there will be an "increase in (the company's share repurchase program up to a total of $30 billion through 2023", and this suggests that the company needs to buy back around $4 billion worth of shares every quarter between Q2 2022 and Q4 2023 to meet its share buyback target. Exxon Mobil is on track to achieve its $30 billion share repurchase goal, as seen with the amount of monies allocated to share buyback in the recent quarter.

In the subsequent two sections of the article, I highlight another key component of Exxon Mobil's shareholder capital return plans: dividends.

What Should Investors Know About Exxon Mobil's Dividend?

There are a couple of key things regarding Exxon Mobil's dividend that income-focused investors should be aware of.

One key thing is Exxon Mobil's dividend growth track record.

At the company's Investor Day in March 2022, XOM emphasized that it had "sustained annual dividend growth for 39 consecutive years in a row." Exxon Mobil last raised its quarterly dividend per share in the final quarter of last year by +$0.01 to $0.88. Furthermore, there are expectations that Exxon Mobil will continue to grow its dividends in the future. According to the sell-side's consensus financial forecasts obtained from S&P Capital IQ, XOM's annual dividend per share is projected to increase by a CAGR of +4.2% for the FY 2022-2025 period.

Another key thing is that XOM has the ability to sustain its current dividend payout, and there is a very low risk of dividend cuts going forward.

Exxon Mobil highlighted at its Q2 2022 investor briefing that its breakeven declined from $44 per barrel in 2021 to $41 per barrel in early-2022, and the company has targeted a further reduction in its breakeven to $35 per barrel. Moreover, XOM continues to deleverage, and its gross debt-to-capital ratio has decreased to 20% as of the end of the second quarter of 2022. Previously, Exxon Mobil had indicated at its March 2022 Investor Day that its goal is to maintain a gross debt-to-capital ratio in the 20%-25% range, so the company has already achieved this goal in the recent quarter. In other words, a low breakeven and a comfortable financial leverage ratio put XOM in a good position to maintain the company's current dividends at the very least.

The final thing is that Exxon Mobil's shareholder mix is a key consideration for the company when it decides on its shareholder capital return initiatives. XOM mentioned at its Investor Day that approximately 45% of its shareholders are individual investors (as opposed to institutional investors), and it stressed that "we do understand how important the dividend is to our shareholders." This makes it more likely that Exxon Mobil will continue to prioritize dividends as a key component of its capital allocation and shareholder capital return.

I do a comparison of Exxon Mobil with its key peers on the dividend yield metric in the next section.

Is Exxon Mobil's Dividend Better Than Its Competitors?

Exxon Mobil's dividend yield is superior to that of its key competitors and peers, namely the other US oil majors, which is another key investment merit for XOM.

Peer Comparison For Exxon Mobil

Stock Consensus Forward Fiscal 2022 Dividend Yield Consensus Forward Fiscal 2023 Dividend Yield Consensus Forward Fiscal 2024 Dividend Yield Exxon Mobil 4.0% 4.2% 4.3% Chevron Corporation (CVX) 3.7% 3.9% 4.1% ConocoPhillips (COP) 2.0% 2.2% 2.9%

Source: S&P Capital IQ

As per the table presented above, XOM boasts much more attractive forward dividend yields as compared to its key competitors like CVX and COP. In absolute terms, Exxon's consensus forward dividend yields of 4% and higher are very appealing as well.

Is Exxon Mobil A Good Long-Term Investment?

Exxon Mobil is a good long-term investment, because of the company's willingness to invest in energy projects and its relatively higher reserve life.

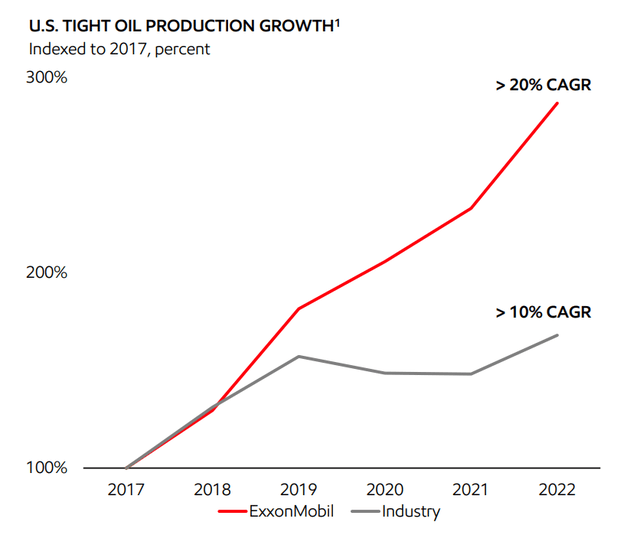

In the past years, many oil majors have cut back on investments in new oil & gas projects, as they wrongly assumed that demand for oil & gas had peaked. In contrast, Exxon Mobil has continued to invest in energy projects based on the belief that oil & gas demand will be higher than what the industry and market expect, and the company has proven to be right. As per the chart below, Exxon Mobil's oil production growth has turned out to be much higher than the industry average. The company's contrarian strategy and approach will translate into higher free cash flow and lower breakeven for XOM in the future.

A Comparison Of Oil Production Growth For XOM And The Industry

XOM's Q2 2022 Earnings Presentation

Separately, Exxon Mobil also boasts a higher reserve life as compared with the other oil majors. This supports higher dividends for the company in the future, as XOM doesn't have to set aside that much capital for reinvestment to extend its reserve life. Based on a June 24, 2022 Americas Energy sector research report (not publicly available) published by Goldman Sachs (GS), Exxon Mobil's reserve life is close to 14 years, while the reserve life for its peers, the other oil companies, such as Chevron, BP (BP) and Shell (SHEL) are 10 years or shorter.

Is XOM Stock A Buy, Sell, Or Hold?

I rate XOM stock as a Buy. Exxon Mobil is both an attractive dividend play and a good long-term investment.

Asia Value & Moat Stocks is a research service for value investors seeking Asia-listed stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e., buying assets at a discount, e.g., net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e., buying earnings power at a discount in great companies like "Magic Formula" stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!

Source: https://seekingalpha.com/article/4531937-is-exxon-mobil-good-dividend-stock

Post a Comment for "How Many Continuous Years Has Exxommobil Paid a Dividend"